Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

A practical overview designed for attorneys new to financial reporting. The session connects GAAP concepts to legal contexts, including fraud cases, merger and acquisition due diligence, financial disclosures, and regulatory examinations, giving practitioners a solid baseline for interpreting accounting information in legal work.

The False Claims Act continues to be the federal Government’s number one fraud fighting tool. ...

Designed for legal practitioners, this session explains the structure and purpose of GAAP through a ...

MODERATED-Session 4 of 10 - Mr. Kornblum, a highly experienced trial and litigation lawyer for over ...

MODERATED-Attorneys may offer a crucial role in discussing advance (end of life) care planning optio...

This Shakespeare?inspired program illustrates how Shakespearean technique can enrich courtroom advoc...

The “Chaptering Your Cross” program explains how dividing a cross?examination into clear...

Evidence Demystified Part 2 covers key concepts in the law of evidence, focusing on witnesses, credi...

MODERATED-This CLE will cover the critical ethics issues involving multijurisdictional practice and ...

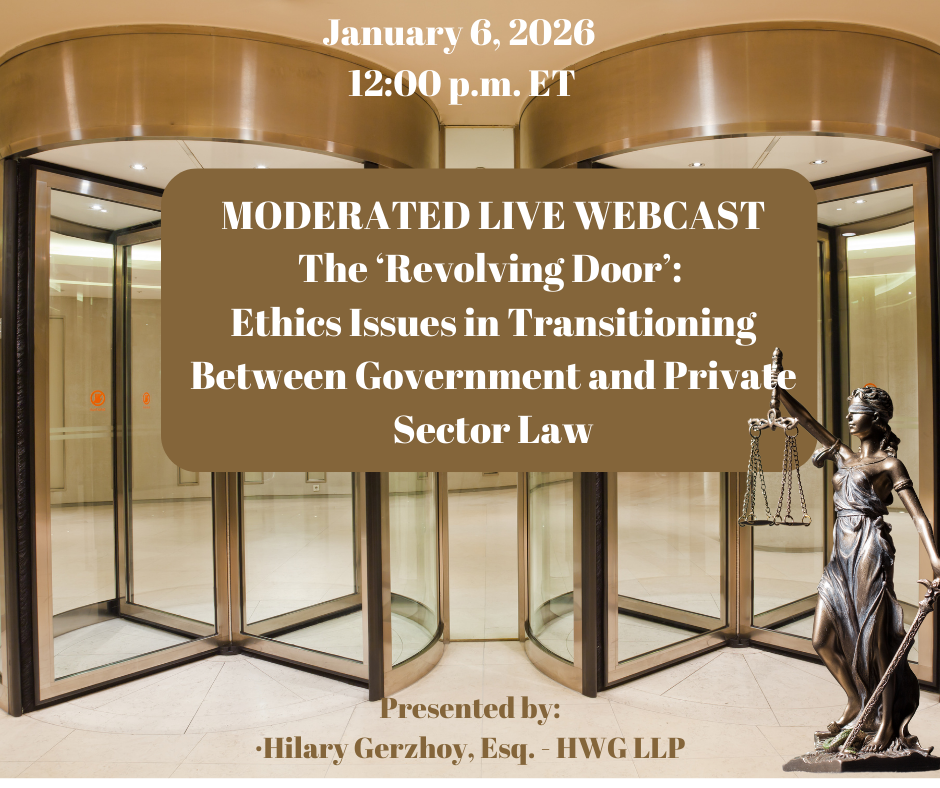

This CLE will cover the critical ethics issues involved in leaving government practice for the priva...

The direct examination presentation outlines how attorneys can elicit truthful, credible testimony w...